Payments in Poland, 2020 Report

Poland's payment market had been growing fast until early 2020 when the trend came to an abrupt halt due to covid19 related business closures and highly reduced economic activity. While the total number of payments in Poland exceeded 8.8 billion in 2019, after increasing over 17% yoy, it is expected to stagnate and fall slightly in 2020.

Outlook

It can be expected that after the temporary stagnation in payment volumes, triggered by covid-19, the payment industry in Poland will gradually resume the growth. This will be, in particular, an effect of strong growth in eCommerce, replacing traditional, cash-intensive retail (B&M). Consequently, the very payment methods which are heavily used on the Internet are likely to benefit the most.

--------------------------------------------------------------------------------------------------------------------------------------

Table of contents

Executive Summary

1. Payments in Poland and in Europe

Slide 1: Consumer markets in Europe, 2019

Slide 2: Total payments in Poland, structure by type, 2015-2020F

Slide 3: Total payments: Europe vs. Poland, structure by type, 2019

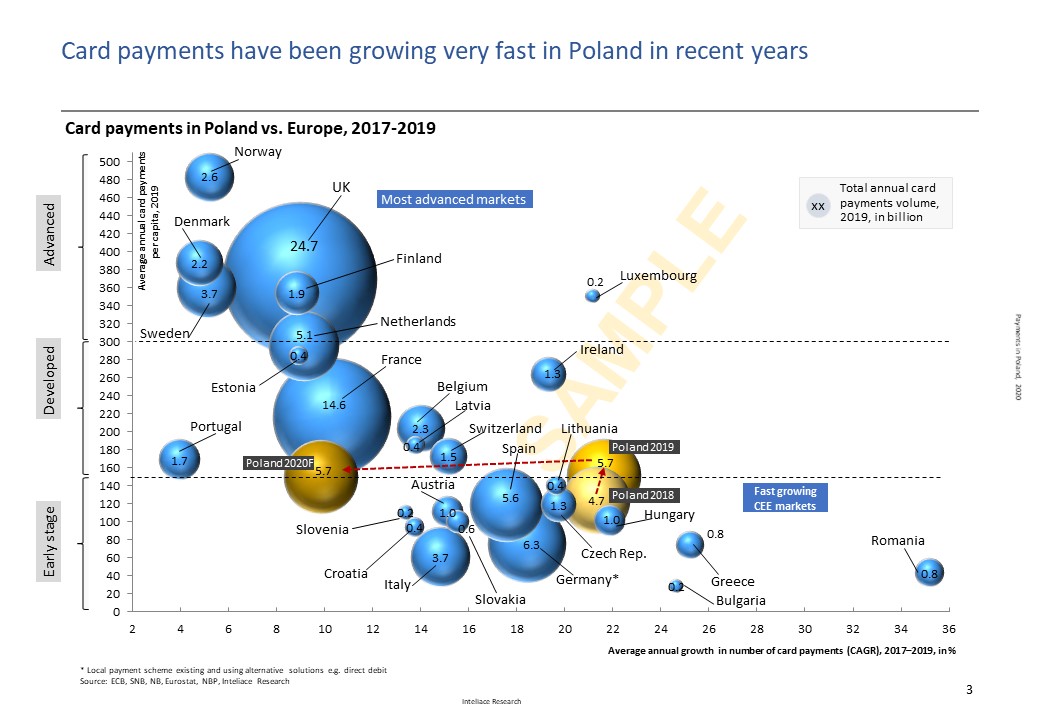

Slide 4: Card payment volumes in Europe & in Poland (1/2), 2017-2019

Slide 5: Card payment volumes in Europe & in Poland (2/2), 2019

2. Payments and payment infrastructure in Poland

Slide 6: Card payments in Poland, 2015-2020F

Slide 7: POS infrastructure evolution in Poland, 2015-2020 H1

Slide 8: ATM networks in Poland, 2015-2020 H1, Top ATM operators

Slide 9: Cash withdrawals in Poland, 2015-2020F

Slide 10: Cash in circulation and interest rates in Poland, 2012-Sep.2020

Slide 11: Cards issued in Poland, 2015-20H1, split by type & brand, 2020H1

Slide 12: Cards/terminals in Poland by functionality, 2016-2020 H1

Slide 13: Top issuers of payment cards in Poland, 2020 H1

Slide 14: Automated Clearing House (ACH) in Poland; Transaction volumes: ELIXIR, Express ELIXIR, SORBNET2, BlueCash, BLIK, 2014-2020H1

Slide 15: Overview of mobile payments in Poland by origin of funds, 2020 H1

Slide 16: Key banks and mobile payment services supported, 2020 H1

Slide 17: Evolution of online/mobile banking users 2018-2020 H1

Slide 18: Number of cards used in mobile payments/wallets, 2020 H1

Slide 19: PSD2 – first implementations in Poland

3. Retail landscape (merchants) and payment methods

Slide 20: Brick&mortar (b&m) vs. online retail landscape, 2019

Slide 21: Key payments methods available in B&M and in online retail, 2020

Slide 22: Survey on payment methods in 58 large online stores, Oct. 2020

Slide 23: Online merchants & payment methods– case (1/3): Allegro

Slide 24: Online merchants & payment methods– case (2/3): RTVEuroAGD

Slide 25: Online merchants & payment methods– case (3/3): empik.com

Slide 26: Key players in specialized mobile payments in public /municipal transportation, 2019

4. Key players by segment

Slide 27: Mobile payments (1/3): BLIK

Slide 28: Mobile payments (2/3): Google Pay

Slide 29: Mobile payments (3/3): Apple Pay

Slide 30: Digital wallets (1/2): MasterPass

Slide 31: Digital wallets (2/2): VISA Checkout

Slide 32: Payment aggregators (1/2): Przelewy 24/Dotpay/eCard

Slide 33: Payment aggregators (2/2): PayU

Slide 34: Digital wallet with hybrid funding: PayPal

5. Forecast

Slide 35: Total payments in Poland forecast (2022)

End of report.

Payments in Poland, 2020

Payments in Poland, 2020