List of Top 200 banks in Central and Eastern Europe (CEE15), edition 2021

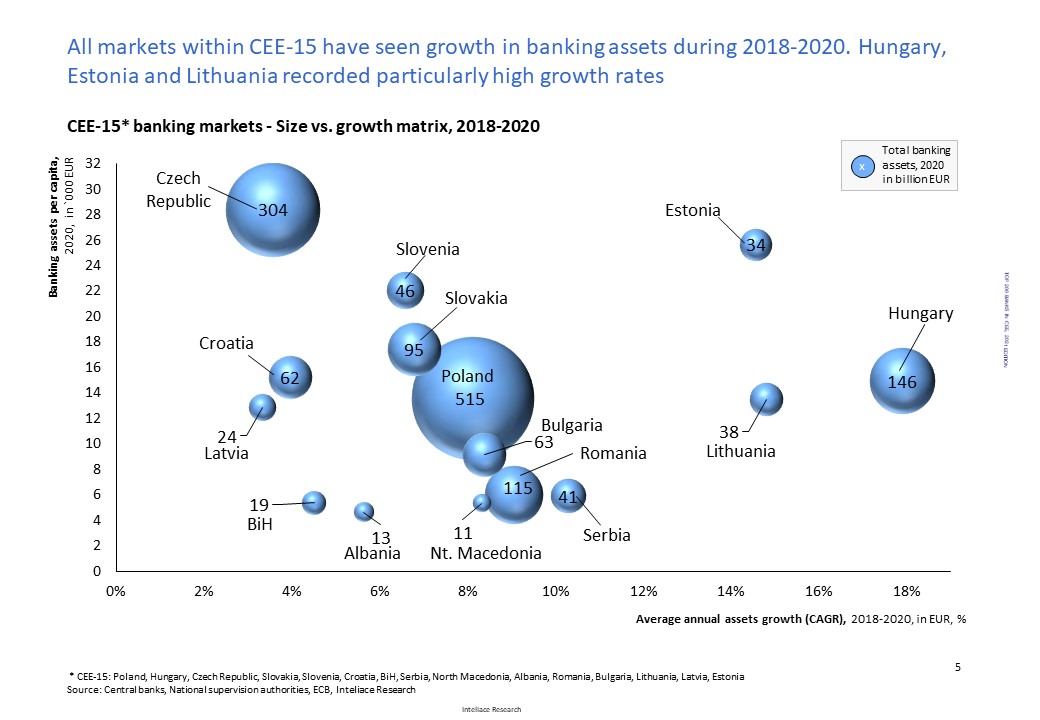

Total banking assets in CEE15* exceeded EUR 1.5 trillion in December 2020, after adding over 8% last year.

Multiple banking markets in the region recorded double digit growth rates, and in a few countries, including Lithuania and Estonia the growth rate exceeded 20%.

However, the growth came at the price of profits. Profitability ratios for top CEE banks plunged in 2020 with ROA and ROE falling to 0.53% and 5.0% respectively.

The top banking groups in the region did not change and Erste, KBC and UniCredit remaind top banking groups. Nevertheless, the consolidation processes continued with regional players getting stronger, in particular OTP,

which continued to consolidate more assets in the southern part of the region.

------------------------------------------------------------------

*CEE15 include: Poland, Czech Republic, Hungary, Slovak Republic, Romania, Bulgaria, Estonia, Latvia, Lithuania, Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Albania, and North Macedonia.

Table of contents

1. CEE-15 Banking Markets

Slide 1: Report coverage: Number of large banks by country, 2020

Slide 2: CEE banking markets: size vs. growth matrix, 2018-2020

Slide 3: Bank assets per capita, bank assets per GDP, 2020

Slide 4: Changes in bank assets by country, 2019-2020

Slide 5: Top 10 banking groups in CEE, 2020

Slide 6: CEE-15 and Top 200 assets evolution 2015-2020

Slide 7: Profitability of Top CEE banks, 2020: ROA, ROE

2. List of 200 major banks in CEE-15 as of 2020

Slide 8: Top 200 - League table: Banks 1-25

Slide 9: Top 200 - League table: Banks 26-50

Slide 10: Top 200 - League table: Banks 51-75

Slide 11: Top 200 - League table: Banks 76-100

Slide 12: Top 200 - League table: Banks 101-125

Slide 13: Top 200 - League table: Banks 126-150

Slide 14: Top 200 - League table: Banks 151-175

Slide 15: Top 200 - League table: Banks 176-200

Note on methodology

End of report.

List of Top 200 banks in Central and Eastern Europe /2021 edition/

List of Top 200 banks in Central and Eastern Europe /2021 edition/