List of Top 200 banks in Central and Eastern Europe (CEE16), edition 2022

Total banking assets in CEE16* topped EUR 1.7 trillion as of December 2021, growing at 11% YoY.

It has been a good time for most banks operating across Central and Eastern Europe recently. Despite continued COVID-19 related lockdowns and business disruptions, as well as in view of new regulatory and tax burdens, CEE banks seem to have coped well with all the headwinds.

All countries in the region had a positive contribution to this growth with leaders experiencing YoY growth rates of 14%+.

With € 138+ billion in assets, Austrian Erste Group remains at the top of regional players. KBC follows the suit with assets worth € 122 billion. Other groups with a market share of 5%+ include: UniCredit, PKO Bank Polski, OTP Bank and Raiffeisen. Overall top 10 largest groups control nearly 52% of regional bank assets.

------------------------------------------------------------------

*CEE16 include: Poland, Czech Republic, Hungary, Slovak Republic, Romania, Bulgaria, Estonia, Latvia, Lithuania, Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Albania, Montenegro and North Macedonia.

Table of contents

1. CEE-16 Banking Markets

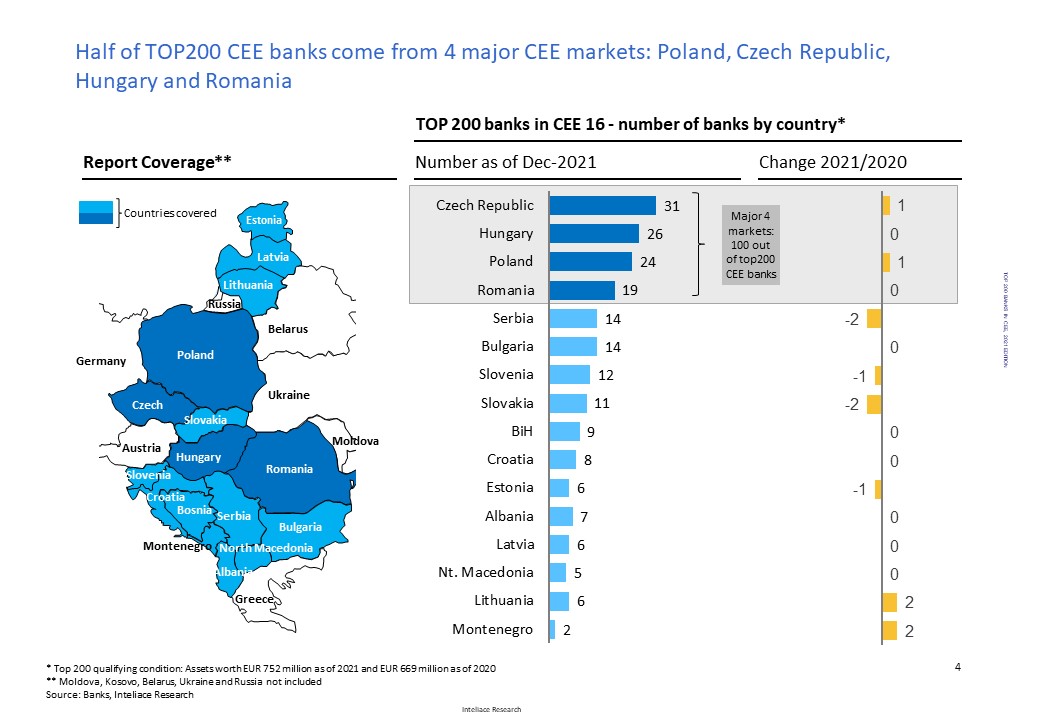

Slide 1: Report coverage: Number of large banks by country, 2021

Slide 2: CEE banking markets: size vs. growth matrix, 2019-2021

Slide 3: Bank assets per capita, bank assets per GDP, 2021

Slide 4: Changes in bank assets by country, 2020-2021

Slide 5: Top 10 banking groups in CEE, 2021

Slide 6: CEE-15 and Top 200 assets evolution 2016-2021

Slide 7: Profitability of Top CEE banks, 2021: ROA, ROE

2. List of 200 major banks in CEE-16 as of 2021

Slide 8: Top 200 - League table: Banks 1-25

Slide 9: Top 200 - League table: Banks 26-50

Slide 10: Top 200 - League table: Banks 51-75

Slide 11: Top 200 - League table: Banks 76-100

Slide 12: Top 200 - League table: Banks 101-125

Slide 13: Top 200 - League table: Banks 126-150

Slide 14: Top 200 - League table: Banks 151-175

Slide 15: Top 200 - League table: Banks 176-200

Note on methodology

End of report.

List of Top 200 banks in Central and Eastern Europe /2021 edition/

List of Top 200 banks in Central and Eastern Europe /2021 edition/