Research report: Mortgage lending in Poland, 2024

The residential construction industry in Poland continued to be impacted by negative trends that began in 2022. Declines in building starts (-9% YoY), permits (-19% YoY), and completions (-8% YoY) were recorded in 2023. This reduced supply of new real estate, combined with demand stimulation resulting from a new government-sponsored program dedicated to first-time homebuyers, was reflected in accelerating real estate prices. As the prices of real estate break all-time records, the affordability for buyers keeps falling, which is a key factor supporting the growth in new mortgage lending.

The recent downturn in real estate construction, seen in 2022 and 2023, is expected to reverse due to rising property prices and new governmental support programs that are anticipated to boost demand. The impact of the monetary factor—namely high interest rates—is projected to diminish in 2024 and 2025, which should further support growth in new mortgage lending. This sector is poised for additional momentum from a new government lending support scheme planned for 2024. Assuming these conditions, our base scenario forecasts a slight increase in overall mortgage lending in 2024, followed by a more significant rise in 2025 and 2026. Total outstanding lending is estimated to reach PLN 545 billion by 2026, with the loan-to-GDP ratio expected to stabilize at approximately 13%.

For more information on recent developments in the Polish banking sector, please refer to the full publication.

Table of contents

Executive summary

1. Residential real estate stock & prices

Slide 1: New dwellings completed, starts, permits, 2010-2023

Slide 2: New dwellings completed by regions, 2023

Slide 3: Residential real estate prices in key cities, 2014-2023

Slide 4: Value and volume of transactions involving real estate, 2017-2022

2. Mortgage lending

Slide 5: Total outstanding lending to households by type of loan, 2019-2023

Slide 6: Mortgage loans to households outstanding, local vs. foreign currency, 2019-2023

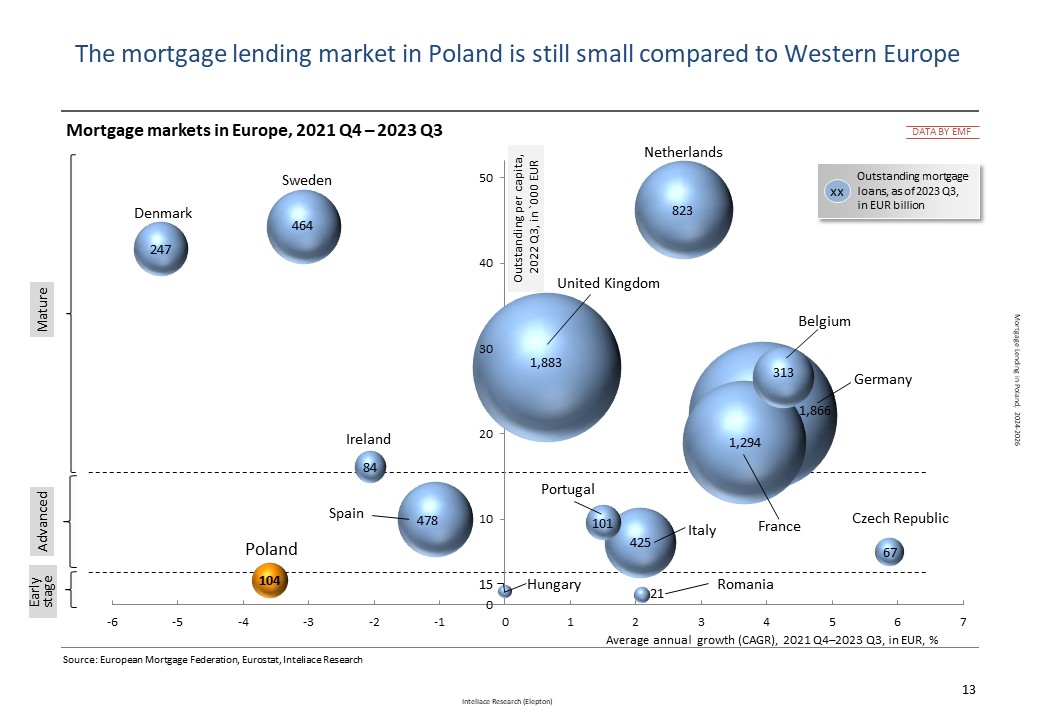

Slide 7: Mortgage lending penetration benchmarks - International comparison, 2023 Q3

Slide 8: Mortgage lending in Poland vs. Europe- market size vs. growth, 2021-2023 Q3

Slide 9: Number of new mortgage loans, value of new loans, average new loan size, 2019-2023

Slide 10: New sales of mortgage loans to individuals monthly/annual averages: 2019- Dec.2023

Slide 11: New mortgage loans by size and LTV, 2019 - 2023 Q3

Slide 12: Top banks by outstanding mortgage loans, 2023 Q3 vs. 2022 Q3

Slide 13: The latest governmental first-time home buyers programs for 2023 & 2024

Slide 14: New mortgage contracts - split by type of interest rate applied (fixed ARM vs. variable), 2021 Q4- 2023 Q3

Slide 15: Average lending margins evolution – PLN loans, 2019-2023

Slide 16: The evolution of mortgage loan NPLs, 2020-2023

3. Forecast

Slide 17: Mortgage loans – outstanding value forecast (PLN, FX loans), GDP penetration, 2024-2026

Methodological notes

End of report

Research Report: "Mortgage lending in Poland, 2024-2026"

Research Report: "Mortgage lending in Poland, 2024-2026"