Research report: Mortgage lending in Poland, 2025

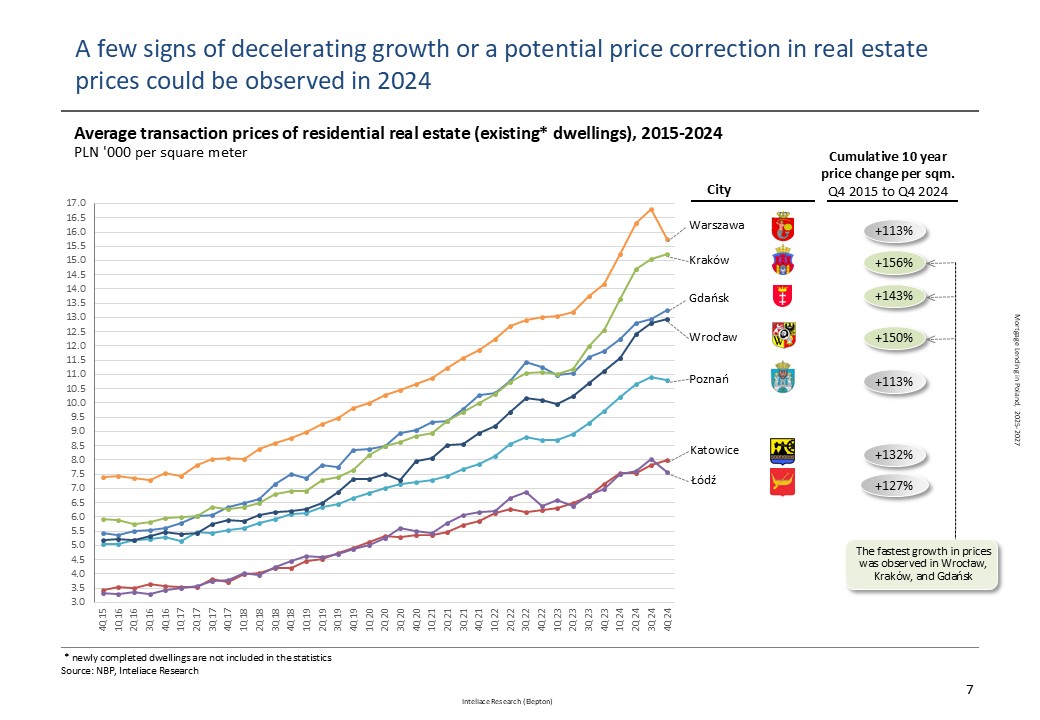

The housing sector reflected divergent trends in 2024. While building permits and housing starts recovered, completions declined to 200,000 units (down from 221,000 in 2023). This contraction can be linked to persistently elevated real estate prices and the discontinuation of government subsidy programs. Developers have adopted a cautious approach by delaying sales amid softening demand at current price levels, potentially anticipating renewed first-time buyer incentives. Notably, the absence of such subsidies in 2024 contributed to moderating property price inflation, though future policy support remains uncertain.

Poland’s mortgage market is poised for steady growth through 2027, supported by sustained economic momentum and improving housing affordability. Despite the lack of confirmed government interventions for first-time buyers, moderating property prices and rising disposable incomes are expected to sustain lending volumes. Under a baseline scenario (assuming no major policy shifts), outstanding mortgage balances are projected to reach PLN 647 billion by 2027, with the mortgage-to-GDP ratio recovering from 13% to 15%. A critical risk to this outlook remains the trajectory of interest rates. The Monetary Policy Council (RPP) faces mounting pressure to sustain a restrictive monetary policy to offset expansionary fiscal measures. Any recalibration of rates—whether upward or downward—would materially influence borrowing costs, affordability, and ultimately, lending activity.

For more information on recent developments in the Polish banking sector, please refer to the full publication.

Table of contents

Executive summary

1. Residential real estate stock & prices

Slide 1: New dwellings completed, starts, permits, 2010-2024

Slide 2: New dwellings completed by regions, 2024

Slide 3: Residential real estate prices in key cities, 2015-2024

Slide 4: Value and volume of transactions involving real estate, 2017-2023

2. Mortgage lending

Slide 5: Total outstanding lending to households by type of loan, 2020-2024

Slide 6: Mortgage loans to households outstanding, local vs. foreign currency, 2020-2024

Slide 7: Mortgage lending penetration benchmarks - International comparison, 2024 Q3

Slide 8: Mortgage lending in Poland vs. Europe- market size vs. growth, 2022-2024 Q3

Slide 9: Number of new mortgage loans, value of new loans, average new loan size, 2020-2024

Slide 10: New sales of mortgage loans to individuals monthly/annual averages: 2019- Dec.2024

Slide 11: New mortgage loans by size, and by LTV, 2019 - 2024 Q3

Slide 12: Top banks by outstanding mortgage loans, 2024 Q3 vs. 2023 Q3

Slide 13: New mortgage contracts - split by type of interest rate applied (fixed ARM vs. variable), 2021 Q4- 2024 Q3

Slide 14: Average lending margins evolution – PLN loans, 2020-2024

Slide 15: The evolution of mortgage loan NPLs, 2022-2024

3. Forecast

Slide 16: Mortgage loans – outstanding value forecast (PLN, FX loans), GDP penetration, 2025-2027

Methodological notes

End of report

Research Report: "Mortgage lending in Poland, 2025-2027"

Research Report: "Mortgage lending in Poland, 2025-2027"